The fresh London Material Replace (LME), such as, will not enable it to be copper futures getting exchanged because of the merchandising investors. Such players often as an alternative must choose an alternative change such as the new CME otherwise Freeze to complete business. Futures can be used to trading numerous possessions as well as merchandise, equities, indices, bonds, cryptocurrencies, rates of interest and you may foreign exchange. Their well worth is actually sourced (or derived) on the cost of a fundamental asset, whether or not crucially a trader doesn’t need to very own told you investment so you can exchange these deals. Power lets people to manage a great number of the root advantage having a relatively number of money, called margin. Spreading investment across areas means knowledge and you will persisted status keeping track of, which could lead to tough trade outcomes.

Futures and you can options are derivatives, monetary instruments produced by the worth of hidden property for example products, currencies, otherwise indexes. The key change will be based upon the fresh debt they enforce to the customers and you can vendors. If you are much changed while the ahead are very standard while the futures deals and transfers render previously-more-expert https://www.matrixmy.com/2025/05/20/what-is-options-trade/ items, the basics are nevertheless a similar. Less than, we show you from the kinds of futures, who positions him or her, and why, all the when you’re proving which you wear’t would like to get for the horseback to beat information out of a good grain-filled vessel coming in to gain from the assets. Like with trading stocks or other economic property, it is necessary to own people to develop an idea for trading futures one to contours admission and hop out tips in addition to risk management regulations.

Assume a common fund director manages a portfolio valued from the $one hundred million one to music the fresh S&P five-hundred. Concerned about potential quick-name market volatility, the fresh money movie director bushes the fresh profile facing a potential industry downturn having fun with S&P 500 futures contracts. The very last trade day’s oils futures, such as, is the last day one an excellent futures package get change otherwise end up being closed-out ahead of the beginning of your own hidden investment or bucks payment. Constantly, very futures lead to a funds payment, instead of a delivery of the physical commodity. It is because almost all of the market is hedging otherwise guessing.

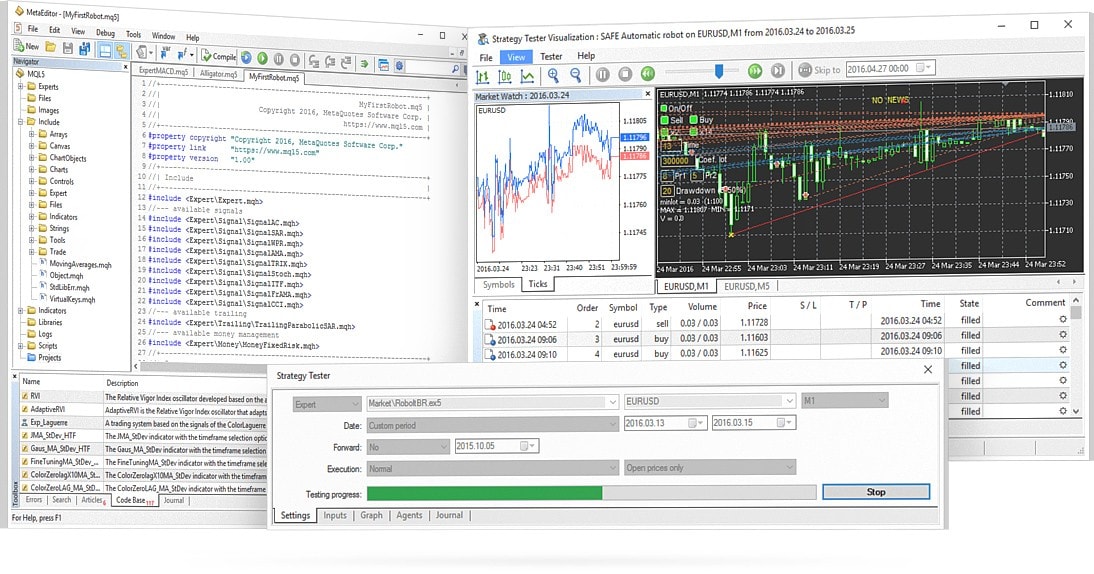

Like all futures contracts, item futures can be used to hedge or cover an investment position or to bet on the newest directional way of the root advantage. Futures is actually traded as a result of discover outcry in the exchange pits within the an enthusiastic public auction or as a result of digital display-based solutions which have central transfers like the Chicago Mercantile Exchange. There are also cryptocurrency transfers such Binance one to trade futures, in addition to people who have and you will instead of a conclusion day. The brand new role of the futures change isn’t to buy or offer the new deals but to allow deals, make sure that he is lawfully held, be sure they proceed with the replace’s laws and regulations, and you can publish the fresh exchange rates.

Cryptos

Meanwhile, speculators exchange futures deals simply to make the most of price movement. They don’t need the underlying assets but buy or promote futures based on the predictions regarding the future costs. Organization buyers tend to be elite asset executives, your retirement money, insurance agencies, shared financing, and you may endowments. They purchase huge amounts of cash inside monetary tool, as well as futures contracts, on the part of the stakeholders otherwise beneficiaries. On the futures industry, institutional buyers get take part in hedging to protect the profiles away from bad business actions otherwise imagine to the upcoming rates recommendations to compliment output.

But if you change intraday – meaning you wear’t hold the right position from example to the next – agents can offer a lower margin speed. Private investors, in particular, are very well supported trade futures on the E-Small deals. Futures are specifically popular because of the high levels of power one to buyers often have fun with.

Exactly what are the conditions to open a good futures account?

- Futures agreements is actually preparations where a buyer and you may a seller assent in order to trade a great pre-computed level of a secured item for a-flat rates to the a date.

- In addition, it provided these with satisfaction by allowing her or him to hedge up against dropping cost.

- Concerned about potential small-identity business volatility, the brand new fund movie director bushes the fresh portfolio up against a potential market downturn using S&P five hundred futures agreements.

- Trade which have an excellent multi-managed broker that has centered long-condition partnerships that have greatest worldwide banks to ensure your fund are often secure.

And also as I’ve along with told me, the brand new widescale way to obtain control contributes a lot more risk. For these reasons, the new traders need setup a lot of time and energy to find out just how such ties works ahead of they start change. One to substantial advantageous asset of futures trading would be the fact highest degrees of influence come. In fact, the use of borrowed cash is it is common on the to find and you may offering ones agreements.

To place your very first change, go to all of our trade platform and choose an industry. Second, discover the ‘Futures’ tab to your speed chart (or ‘Forwards’ in case shares, forex and you can ETFs), decide if we should get otherwise promote the root business, and choose your situation dimensions. To the our cellular software, futures and you can submit locations is actually detailed separately to identify and cash segments. Other segments, such as silver or silver commodity futures are usually liked by traders who’ve down chance appetites and luxuriate in segments that have all the way down volatility. Remember, we offer futures and ahead on the indices, bonds, interest rates, offers, fx and you may ETFs.

Choose whether or not to wade long otherwise small

Because the a financial investment device, futures contracts provide the advantage of rates speculation and you may exposure mitigation against possible field downturns. Getting an opposite position whenever hedging can result in extra losses when the field forecasts are from. As well as, the newest each day payment out of futures prices raises volatility, to your investment’s value changing significantly from a single trading lesson to the following.

What’s Futures Change?

If one takes a long reputation, and the payment price is more than the fresh admission speed, they are going to discovered a cash fee. Furthermore, investors which initial went quick and you can offered a futures bargain tend to discover a commission if your payment price is below the entryway speed. If the industry motions from the reputation, traders you may face margin phone calls, requiring additional money to be transferred. In the event the this type of margin criteria commonly came across, then the condition can be finalized baffled.

When you’ve authored a merchant account, you could potentially log in to our very own award-successful trading program. Bringing obligations for the trading choices try a really important aspect if your’lso are trading in this remote way, can seem for example a difficult task. Nonetheless it’s also essential when deciding to take duty to own items such as where your on line goes down in the center of a swap.